child tax credit november 15 deadline

If you qualified for the federal EITC you may be able to take a state-level credit equal to 30 of your federal credit. Browse all topics Featured.

Child Tax Credit Will There Be Another Check In April 2022 Marca

Distributing 25 of tax revenue to the Compulsive Gamblers Assistance Fund 25 to the General Fund 70 to the Property Tax Credit Cash Fund and 25 to the counties where gambling is authorized at.

. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file taxes this year to get the second half of your money. Or text updates with important deadline reminders useful tips and other information about your health insurance. Earned income credit.

While the deadline to sign up for monthly Child Tax Credit payments this year was November 15 you can still claim the full credit of up to 3600 per child by filing a tax return next year. Most families who received advance CTC payments only received half of the value of their credit. April 15 2019 was the last day to file your original 2015 tax return to claim a refund.

Since your Father already filed and claimed you as a Dependent. Such as if you give your grandchild or great-grandchild a valuable asset instead of your child. Filed a 2019 or 2020 tax return and claimed the Child Tax Credit on the return or.

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. Who is Eligible. The Child Tax Credit changes expired at the end of 2021 and werent extended by the US.

IR-2022-106 Face-to-face IRS help without an appointment available during special Saturday opening on May 14 IR-2022-105 IRS provides guidance for residents of Puerto Rico to claim the Child Tax Credit IR-2022-91 Taxpayers who owe and missed the April 18 filing deadline should file now to limit penalties and interest. The November 2021 Budget suggested that everyone would be moved over to universal credit by 2025. When purchased between November 1 2020 - April 18 2021.

The initiative was designed to impose an annual tax of 20 on gross gambling revenue of licensed gaming operators. Child tax credit is for those who take care of any children eligible for child benefit up to 31 August after they turn 16 or up to 20 if theyre in full-time education or registered with the careers service. Continue using HealthCaregov for 2021 coverage information.

For each child younger than 18 that you adopt during the tax year you can claim a credit that is the greater of 1500 or your actual adoption expenses up to 10000. Your gross estate might be valued at 15 million. TurboTax User Agreements Full Tax Identity Restoration and Identity Theft Monitoring Services Agreement TERMS AND CONDITIONS FOR FULL IDENTITY RESTORATION PREVIOUSLY TAX IDENTITY RESTORATION AND IDENTITY THEFT MONITORING SERVICES.

Enter Payment Info Here tool or. When filing your tax return indicate on the tax return that you ARE a dependent of another. The big question is whether the government will pay parents another Child Tax Credit.

Its on April 18 2022 the Monday following Easter. Parents and children celebrate new monthly Child Tax Credit payments and urge congress to make them permanent outside Senator Schumers home on July 12 2021 in Brooklyn New York. Nebraska Initiative 431.

The November 15 2021 deadline to use the tool has passed. Entered your information in 2020 to get stimulus Economic Impact payments with the Non-Filers. Although its prospects for.

The rest of your Child Tax Credit will be issued in one payment. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. If you are eligible for the Child Tax Credit but dont sign up for advance monthly payments by the November 15 deadline you can still claim the full credit of up to 3600 per child by filing.

You dont want to. Filing a 2021 Federal tax return in 2022 will allow families eligible to claim the 2021 CTC to receive their remaining benefit. Not too late to claim the Child Tax.

Enroll for 2022 as soon as November 1 2021. Which passed the House in November 2021 is pending in the Senate. A tax credit is said to be unified when it applies to two separate taxes.

You must let the tax credit. Tax Day isnt on April 15 2022. Tax Year 2020 Effective Dates.

But with 12 tax brackets two separate individual income tax tables one of which is only for low-income taxpayers and rates of 2 3 34 5 6 and 69 depending on your income youll need to do some calculations to determine your state tax liability. This tax was launched in 1976 to prevent taxpayers from effectively dodging two or more estate taxes on the same. If you received an extension for the 2015 return then your deadline is October 15 2019.

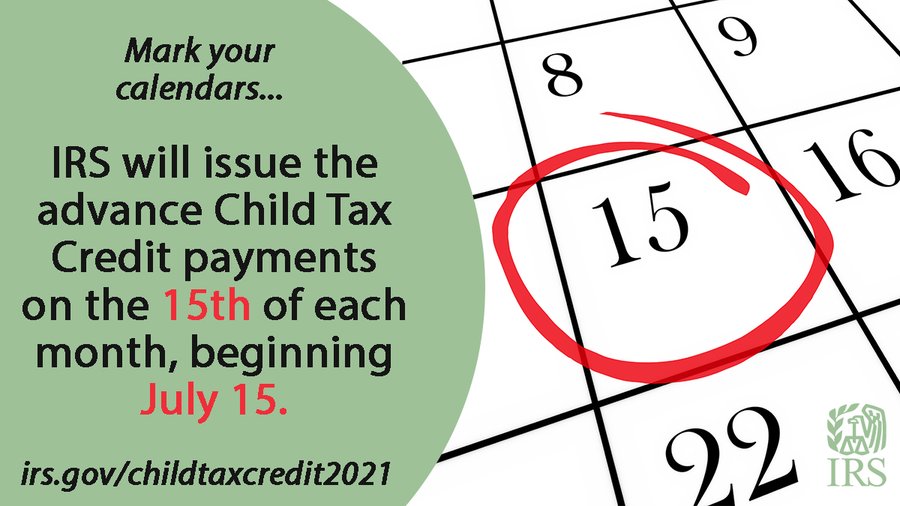

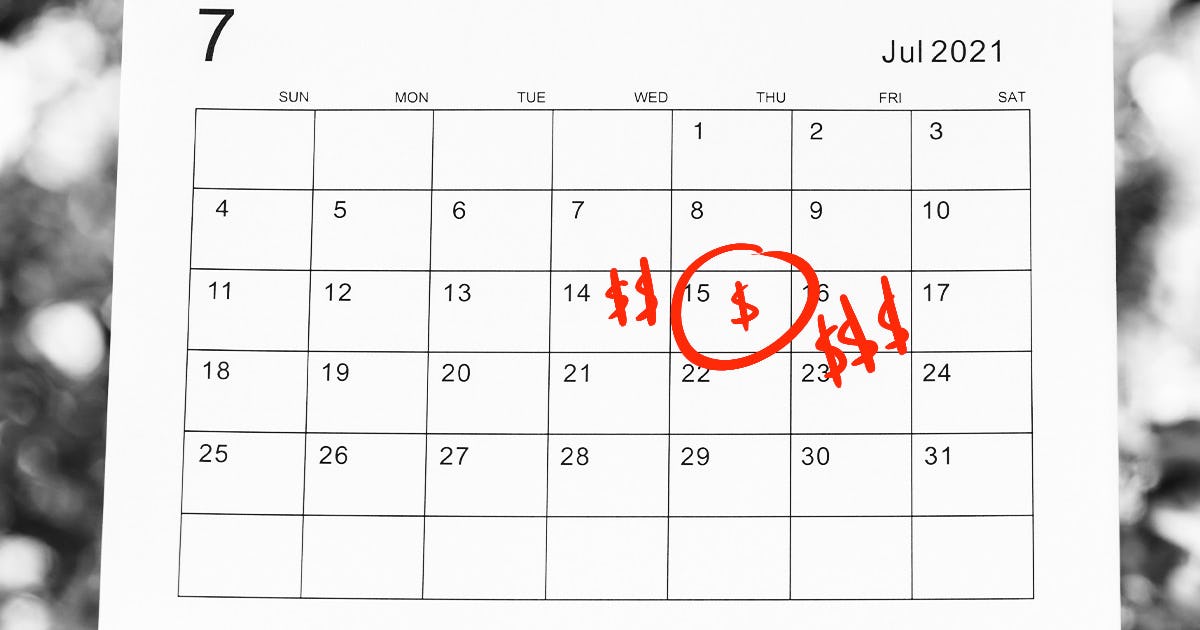

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Child Tax Credit 2021 8 Things You Need To Know District Capital

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1

When Will The 3 000 To 3 600 Child Tax Credit Money Be Sent As Usa

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

Irs Child Tax Credit Money Don T Miss An Extra 1 800 Per Kid Cnet

Do You Know The Health Insurance Deadlines That Happen In March For The Affordable Care Act Health Insurance How To Plan How To Apply

When Are Taxes Due In 2022 Forbes Advisor

Deadline For Filing For Monthly Child Tax Credit Payments Is November 15 Pennsylvania Legal Aid Network

2021 Child Tax Credit Advanced Payment Option Tas

Child Tax Credit Update Next Payment Coming On November 15 Marca

Sign Up For The Child Tax Credit Before November 15th Representative Nikema Williams

Unenrolling From Monthly Child Tax Credit Payments Tax Accountant Financial Planner

Child Tax Credit Deadline Missed Here S What Parents Need To Know

Child Tax Credit Here S When You Ll Get The August Payment Cbs News

The Oklahoma State Building And Construction Trades Council Is Hosting Its Fifth Annual Apprenticeship Open House On N Building Trade Apprenticeship Open House

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson